Q2 2025 PE Insights from V17 Advisors

Capital Concentrates as Middle Market Stalls

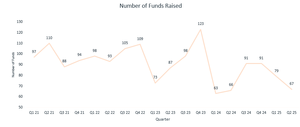

According to the Q2 2025 US PE Breakdown by PitchBook, private equity fundraising remains starkly divided in Q2. The number of new funds declined another 15% to 67, while total capital raised surged 63% to $92.3B, marking the highest quarterly fundraising figure since 2022. The average fund size exploded to $1.38B, a 92% quarter-over-quarter increase and the largest on record for this dataset.

Beneath the headline, the story is one of consolidation. Large-cap managers continue to draw capital at the expense of emerging and middle-market funds. Thoma Bravo’s $24.3B close and its $8.1B Discover Fund accounted for over a third of the quarter’s capital raised, obscuring broader challenges for less established managers.

Deals: Bigger Isn’t Always Busier

Deal volume dipped 5% quarter-over-quarter to 2,158 transactions, but deal value remained strong at $227.7B, down 18% from Q1 but still up 11% year-over-year. Q2 saw a flurry of megadeals, including Blackstone’s $11.5B acquisition of TXNM Energy and Thoma Bravo’s $10.6B carveout of Boeing’s Digital Aviation Solutions unit.

Yet it wasn’t all smooth sailing. Take-private activity fell 41% quarter-over-quarter in value as sponsors paused amid rising public equity prices and volatile financing costs. Add on deals surged to 75.9% of all buyouts, showing managers continue to prioritize scale and operational synergy in a high rate world.

Exits: Window Narrows, Alternatives Rise

Exit activity faltered. Total exit value dropped 46% QoQ to $118.5B, while exit count fell 25% to 314, the lowest in over a year. With traditional M&A slowing, GPs leaned more heavily into continuation funds, tracking toward another record year, with 70 deals and $22.1B already disclosed in H1.

Sponsor to sponsor exits held relatively firm, led by Brookfield’s $9B acquisition of Colonial Pipeline. But corporate buyers retreated amid macro uncertainty, with many delaying M&A plans in response to tariff and trade disruptions.

Valuations and Leverage: Steady but Selective

Valuations remained elevated but stabilized. The TTM EV/EBITDA multiple for US buyouts was 12.8x, just below 2024’s high of 13.0x. Buyout financing remained rational, with leverage ratios (i.e. debt/EBITDA) steady at 5.1x and equity contributions holding firm near 47% of capital stacks.

Sector Watch: Tech Resilience, B2B Hesitates

Technology stood out as the quarter’s most resilient sector. The $24.3B sale of Worldpay by GTCR to Global Payments highlighted strong demand for scaled platforms, even amid broader exit malaise.

B2B sectors, by contrast, faced tariff driven headwinds. Only one B2B exit in Q2 exceeded $500M, reflecting the caution with which buyers are approaching supply chain heavy industries.

Conclusion: Concentration, Continuation, and Caution

Q2 2025 reaffirmed the growing concentration of capital among brand name managers. While aggregate fundraising surged, fund count declined. Exits slowed, but continuation funds and strategic megadeals kept activity afloat. Deal flow was steady, but the real action favored the upper end of the market.

Key questions for Q3:

- Will middle-market funds regain investor confidence or remain sidelined?

- Can continuation funds keep absorbing exit pressure?

- How will tariff volatility impact sector strategies and carveout opportunities?

At V17 Advisors, we partner with PE firms navigating this new reality, where scale matters, specialization wins, and liquidity needs creative structuring. Whether you are preparing for a fund launch, supporting a continuation vehicle, or managing a complex carveout, our CFO and compliance services are built for private equity’s next chapter.

Let’s navigate Q3 with clarity and confidence. Reach out to explore how we can support your team.